Many Americans have taken steps in recent years to protect their identity. However, one report found identity theft hit an all-time high in 2016, affecting an estimated 15.4 million consumers. If you haven’t taken measures to protect yourself, it may be a good idea to consider your options.1

Identity theft is a crime in which an individual illegally obtains and wrongfully uses another person’s personal information—such as a Social Security number, bank account number, or credit card number—generally for financial gain. Once a thief has possession of your personal information, it may be used to obtain a loan, run up credit card debt, or commit other crimes.

Individuals can take four steps to help protect themselves against identity theft. These steps are represented by the acronym SCAM.

S — Be stingy when it comes to giving out your personal information. Make sure the person requesting the information is on a “need-to-know” basis. For example, someone who claims to be calling from your bank does not need to know your mother’s maiden name if it’s already on file with the bank.

C — Check your financial information periodically. If you get hard-copy credit card or bank statements mailed to you, consider keeping these documents in a safe, secure location. Be skeptical if it appears the financial institution missed a month. Identity thieves may try to change the address on your accounts to keep their actions hidden from you for as long as possible.

A — From time to time, ask for a copy of your credit report. This report shows bank and financial accounts in your name and may help provide evidence if someone has used your name to open another account. To obtain a report, contact any of the three major credit bureaus, Equifax, Experian, or Transunion.

M — Maintain good records of your financial accounts and obligations. Experts recommend that you keep hard copies or electronic versions of monthly bank and credit card statements. Easy access to this information may make it easier to dispute a transaction, especially if your signature has been forged.

Government agencies, credit card companies, and individuals have become smarter about protecting data and identifying perpetrators. But identity thieves consistently devise new strategies to obtain personal information.

Having your identity stolen may result in out-of-pocket financial loss, plus the additional cost of trying to restore your good name. Help protect yourself by using caution when sharing your personal information and keeping an eye out for warning signs.

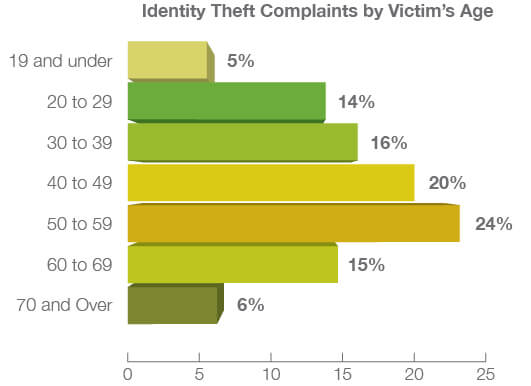

The Age of Risk

Instances of identity theft are more frequent among individuals aged 40 to 60.

Chart Source: Federal Trade Commission, 2016

![]()

Tip: If You’re a Victim. If you think you may have had your identity stolen, take action immediately. Start by contacting the Federal Trade Commission (www.ftc.gov), where you can find information about what to do next.

Tip: If You’re a Victim. If you think you may have had your identity stolen, take action immediately. Start by contacting the Federal Trade Commission (www.ftc.gov), where you can find information about what to do next.

Fast Fact: One well-known case of identity theft involved criminal-turned-FBI-consultant, Frank Abagnale, Jr. During a five-year period in the 1960s, Abagnale assumed at least eight separate identities and amassed millions of dollars using forged checks.

Fast Fact: One well-known case of identity theft involved criminal-turned-FBI-consultant, Frank Abagnale, Jr. During a five-year period in the 1960s, Abagnale assumed at least eight separate identities and amassed millions of dollars using forged checks.

- USA Today, February 6, 2017

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2019 FMG Suite.